Some Known Factual Statements About Amur Capital Management Corporation

Some Known Factual Statements About Amur Capital Management Corporation

Blog Article

Unknown Facts About Amur Capital Management Corporation

Table of ContentsThe Of Amur Capital Management CorporationThe Facts About Amur Capital Management Corporation UncoveredUnknown Facts About Amur Capital Management CorporationTop Guidelines Of Amur Capital Management CorporationRumored Buzz on Amur Capital Management CorporationAmur Capital Management Corporation Can Be Fun For EveryoneExcitement About Amur Capital Management Corporation

A low P/E proportion may indicate that a business is underestimated, or that investors expect the company to face much more challenging times ahead. Investors can utilize the typical P/E ratio of other firms in the very same market to develop a standard.

Excitement About Amur Capital Management Corporation

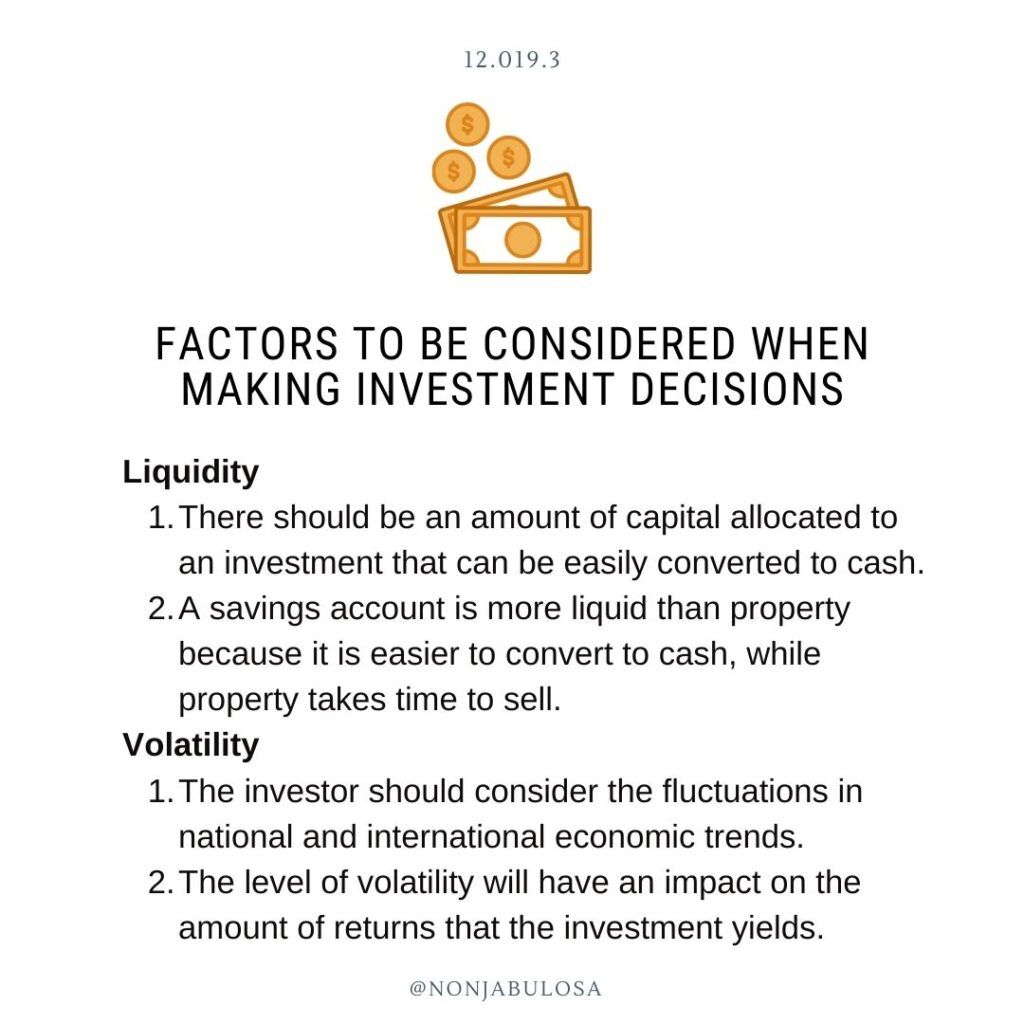

The average in the vehicle and truck sector is just 15. A supply's P/E ratio is very easy to discover on a lot of economic reporting sites. This number suggests the volatility of a stock in contrast to the marketplace all at once. A safety with a beta of 1 will certainly display volatility that corresponds that of the market.

A stock with a beta of over 1 is in theory a lot more unpredictable than the market. A safety with a beta of 1.3 is 30% even more volatile than the market. If the S&P 500 increases 5%, a stock with a beta of 1. https://www.bitchute.com/channel/wfTS3rtGiDAM/.3 can be anticipated to climb by 8%

6 Easy Facts About Amur Capital Management Corporation Explained

EPS is a buck figure standing for the section of a business's profits, after taxes and recommended supply returns, that is designated to each share of ordinary shares. Financiers can utilize this number to evaluate just how well a company can provide value to investors. A greater EPS results in higher share rates.

If a business regularly stops working to supply on incomes forecasts, a financier might intend to reconsider buying the supply - capital management. The computation is easy. If a company has a take-home pay of $40 million and pays $4 million in dividends, after that the remaining amount of $36 million is separated by the number of shares impressive

8 Simple Techniques For Amur Capital Management Corporation

Capitalists typically obtain interested in a stock after checking out headlines regarding its phenomenal performance. Just keep in mind, that's yesterday's news. Or, as the investing pamphlets constantly expression it, "Past performance is not a forecaster of future returns." Sound investing decisions must take into consideration context. A take a look at the trend in rates over the previous 52 weeks at the least is required to get a sense of where a stock's rate might go following.

Allow's consider what these terms suggest, just how they vary and which one is finest for the average capitalist. Technical experts comb via huge volumes of information in an effort to forecast the direction of supply costs. The data is composed mostly of previous prices information and trading quantity. Basic analysis fits the demands of a lot of financiers and has the benefit of making great sense in the real life.

They believe prices comply with a pattern, and if they can understand the pattern they can profit from it with well-timed trades. In current decades, modern technology has made it possible for more capitalists to exercise this design of investing since the tools and the information are a lot more obtainable than ever. Essential experts consider the inherent worth of a stock.

The 6-Second Trick For Amur Capital Management Corporation

Technical evaluation is ideal fit to someone that has the time and comfort degree with information to put unlimited numbers to use. Over a duration of 20 years, annual costs of 0.50% on a $100,000 financial investment will minimize the portfolio's worth by $10,000. Over the same duration, a 1% cost will reduce the very click here to find out more same portfolio by $30,000.

The trend is with you. Numerous common fund business and on-line brokers are decreasing their charges in order to complete for customers. Make use of the pattern and look around for the cheapest expense.

3 Simple Techniques For Amur Capital Management Corporation

, eco-friendly space, breathtaking sights, and the area's condition factor plainly into residential home appraisals. A key when taking into consideration residential or commercial property area is the mid-to-long-term sight concerning exactly how the location is expected to advance over the investment period.

The Amur Capital Management Corporation PDFs

Extensively evaluate the ownership and desired use of the immediate areas where you plan to invest. One method to collect details about the potential customers of the location of the building you are considering is to call the community hall or other public firms accountable of zoning and urban preparation.

This offers routine income and lasting value gratitude. This is generally for quick, small to tool profitthe typical property is under construction and marketed at a profit on conclusion.

Report this page